MEETING DATE

May 9, 2018

MEETING DATE May 8, 2024 | ||

One Quaker Park

HOUGHTON

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

QUAKER CHEMICAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| QUAKER CHEMICAL CORPORATION | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| x | No fee | ||||

| o | Fee paid previously with preliminary materials | ||||

| o | Fee computed on table |

MEETING DATE

May 9, 2018

MEETING DATE May 8, 2024 | ||

One Quaker Park

HOUGHTON

Notice of Annual Meeting of Shareholders

| TIME: | 8: | |||||

| PLACE: | The 2024 Annual Meeting of Shareholders will be held remotely via the Internet at www.virtualshareholdermeeting.com/KWR2024. You will not be able to attend the annual meeting in person. | |||||

| ||||||

| ITEMS OF BUSINESS: | (1)To elect three directors. (2)To hold an advisory vote on the compensation of our named executive officers as described in this proxy statement. (3)To consider and act upon a proposal to approve our 2024 Long-Term Performance Incentive Plan. (4)To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm to examine and report on our financial statements and internal control over financial reporting for

(5)To transact any other business properly brought before the | |||||

| WHO MAY VOTE: | You can vote at the meeting and any adjournment(s) of the meeting if you were a shareholder of | |||||

| ANNUAL REPORT: | A copy of our Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, | |||||

By Order If you plan to participate in the virtual shareholders’ meeting, please see the instructions on page 1 of the Board of Directors,

Robert T. Traub

Vice President, General Counsel

and Corporate Secretary

Conshohocken, Pennsylvania

March 29, 2018

Important Notice of Availability of Proxy Materials

for Quaker Chemical Corporation’s 2018 Annual Meeting of Shareholders to be held on May 9, 2018.

The Notice of Meeting, Proxy Statement and Annual Report on Form 10-K

are available at www.proxyvote.com.

| By Order of the Board of Directors, | |||||

| |||||

| Robert T. Traub | |||||

| Senior Vice President, General Counsel and Corporate Secretary | |||||

Important Notice of Availability of Proxy Materials for Quaker Houghton’s 2024 Annual Meeting of Shareholders to be held on May 8, 2024. The Notice of Meeting, Proxy Statement and 2023 Annual Report to Shareholders are available at www.proxyvote.com. | ||

2024 Proxy Statement|i | |||||

| TABLE OF CONTENTS | |||||

| APPENDIX A - 2024 Long-Term Performance Incentive Plan | |||||

ii | | ||||||

| PROXY STATEMENT | ||||||||||

Corporation doing business as Quaker Houghton.

How does the Board recommend I vote on the proposals?

Shareholderscan attend the Annual Meeting?

2024 Proxy Statement | 1 | |||||

| PROXY STATEMENT | |||||

If there are any technical issues in convening or hosting the meeting, we will promptly post information to our website, https://investors.quakerhoughton.com/event-calendar, including information on when the meeting will be reconvened.

2 | 2024 Proxy Statement | |||||

| PROXY STATEMENT | |||||

You can cast

|

2024 Proxy Statement | |||||||

| PROXY STATEMENT | |||||||

| Proposal | Proposal Description | Votes Required for Approval | Effect of Abstentions(1) | Uninstructed Shares/ Effect of Broker Non-votes(1) | Signed but Unmarked Proxy Cards(2) | |||||||||||||||||

| ||||||||||||||||||||||

Proposal 1 | Election of directors | Majority of votes cast | No effect(3) | Not voted/No effect(3) | Voted “For” | |||||||||||||||||

Proposal 2 | Advisory, non-binding vote to approve executive compensation | Majority of votes cast | No effect(3) | Not voted/No effect(3) | Voted “For” | |||||||||||||||||

| Proposal 3 | Approval of our 2024 Long-Term Performance Incentive Plan | Majority of votes cast | No effect(3) | Not voted/No effect(3) | Voted “For” | |||||||||||||||||

| Proposal 4 | Ratification of the appointment of PricewaterhouseCoopers, LLP as our independent registered public accounting firm | Majority of votes cast | No effect(3) | Discretionary vote by broker | Voted “For” | |||||||||||||||||

4 | 2024 Proxy Statement | |||||

| PROXY STATEMENT | |||||

|

How many votes may I cast at the meeting?

“quorum”?

Who can attend the Annual Meeting?

All shareholders of Quaker who owned shares of record on March 12, 2018 may attend the meeting. If you want to vote in person and you hold Quaker common stock in street name (i.e., your shares are held in the name of a brokerage firm, bank or other nominee), you must obtain a proxy card issued in your name from your broker and bring that proxy card to the meeting, together with a copy of a brokerage statement reflecting your stock ownership as of the record date and valid identification. If you hold stock in street name and want to attend the meeting but not vote in person at the meeting, you must bring a copy of a brokerage statement reflecting your stock ownership as of the record date and valid identification.

If at any time you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, you should contact Victoria K. Gehris, Assistant Secretary, at 610-832-4246,1-610-832-4246, or inform her in writing at Quaker Chemical Corporation,Houghton, Shareholder Services, One Quaker Park, 901 E. Hector Street, Conshohocken, Pennsylvania 19428. If you hold shares through an intermediary and no longer wish to participate in householding, you should contact your bank, broker or other nominee record holder.

2024 Proxy Statement | 5 | ||||||

| PROXY STATEMENT | |||||

6 | 2024 Proxy Statement | |||||

The Quaker

2026 annual meeting.

Yes, Mr. William R. Cook

Mr.

2024 Proxy Statement | |||||||

| PROPOSAL 1 | |||||||

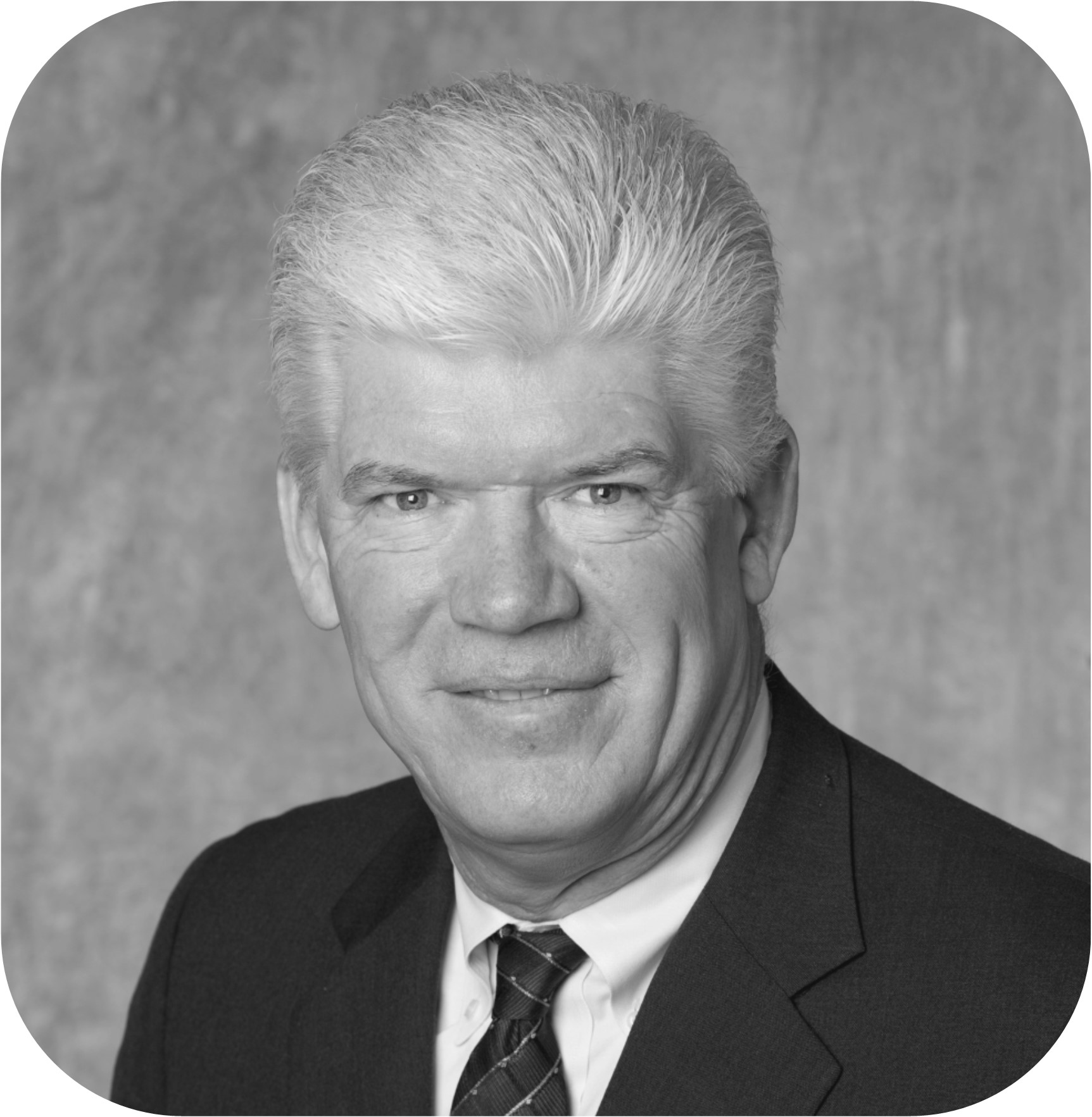

Michael F. Barry, 59

| Michael F. Barry | Not Independent | |||||

Age: 65 Director since: 2008 Chairman since: 2009 Committees: Sustainability Key Skills and Attributes: •Senior Leadership Experience •Risk Assessment •Technology/Science •Manufacturing | Director

| |||||

DIRECTOR QUALIFICATION HIGHLIGHTS

| • | Extensive and valuable experience acquired through |

| Houghton • | Extensive knowledge of accounting/finance, financial reporting, risk assessment, industrial marketing and services, organizational development, global organizations, governance, strategic planning, corporate development, research and development and manufacturing |

• |

Mr. Barry has been our Chief Executive Officer and President since October 2008 and our Chairman of the Board since May 2009. He has held leadership and executive positions of increasing responsibility since joining Quaker in 1998, including Senior Vice President and Managing Director–North America from January 2006 to October 2008; Senior Vice President and Global Industry Leader–Metalworking and Coatings from July to December 2005; Vice President and Global Industry Leader–Industrial Metalworking and Coatings from January 2004 to June 2005; and Vice President and Chief Financial Officer from 1998 to August 2004. Mr. Barry currently serves as a director of Rogers Corporation.

Donald R. Caldwell, 71

|

Career Overview •Quaker Houghton Chief Executive Officer and President from October 2008 until retirement in November 2021. •Mr. Barry also held various leadership and executive positions of Other Public Company Board Memberships •Current Public Company Boards: Arcadium Lithium plc (NYSE: ALTM) (previously known as Livent Corporation) •Previous Public Company Boards (Past Five Years): Rogers Corporation (NYSE: ROG) (from 2010 to 2020) |

DIRECTOR QUALIFICATION HIGHLIGHTS

| Jeffry D. Frisby | ||||||||

Mr. Caldwell, an experienced and successful investor, co-founded Cross Atlantic Capital Partners, Inc., a venture capital management company, and has served as its Chairman and Chief Executive Officer since 1999. He was Chief Executive Officer of InsPro Technologies Corporation, one of Cross Atlantic Capital Partners’ portfolio companies from January 2015 until his resignation on October 9, 2017. Previously, he was President and Chief Operating Officer of Safeguard Scientifics, Inc., a holding company with investments in the growth-stage technology and life sciences businesses, from February 1996 to February 1999. He has been our Lead Director since 2016. He is a director and Chairman of the Board of InsPro Technologies Corporation and a director of Lightning Gaming, Inc., both of which are Cross Atlantic Capital Partners’ portfolio companies. He served as a director of Rubicon Technology, Inc., also a Cross Atlantic Capital Partners’ portfolio company, until his resignation on November 16, 2017. In addition, he is currently a director of Haverford Trust Company and a director and Chairman of the Board of I-AM Capital Acquisition Company. He was a director of Fox Chase Bancorp. Inc. from October 2014 until July 2016.

| Independent | ||||||

Age: 68 Director since: 2006 Lead Director since: 2023 Committees: Compensation and Human Resources; Sustainability Key Skills and Attributes: •Senior Leadership Experience •Organizational Development/Global Organizations •Governance •Aerospace •Manufacturing | ||||||

Jeffry D. Frisby, 62

| Director

|

DIRECTOR QUALIFICATION HIGHLIGHTS

| • | •Extensive knowledge of accounting/finance, financial reporting, industrial marketing, organizational development, global organizations, governance, strategic planning and corporate development |

• | Career Overview •Executive Chairman of PCX Aerostructures, LLC since September 2021, having served as President and Chief Executive Officer from April 2017 until September 2021. PCX Aerostructures is a leading provider of flight critical mechanical systems and components for rotorcraft and fixed wing aerospace platforms. •Chief Executive Officer of Triumph Group, Inc., a public company that manufactures aerospace structures, systems and components, from July 2012 to April 2015, its President from July 2009 to April 2015, and its Chief Operating Officer from July 2009 to July 2012. •Group President of Triumph Aerospace Systems Group, a group of companies that design, engineer and manufacture a wide range of proprietary and build-to-print components, assemblies and systems for global aerospace original equipment manufacturers, from April 2003 to July 2009. •Mr. Frisby also held a variety of other positions within the Triumph Group as well as a predecessor group company, Frisby Aerospace, Inc. •Director of PCX Aerostructures, LLC. Other Public Company Board Memberships •Current Public Company Boards: Astronics Corporation (NASDAQ: ATRO) •Previous Public Company Boards (Past Five Years): None |

Mr. Frisby has been President and Chief Executive Officer

8 | 2024 Proxy Statement | |||||

| Russell R. Shaller | Independent | ||||

Age: 60 Director since: 2023 Committees: Audit; Compensation and Human Resources Key Skills and Attributes: •Senior Leadership Experience •Governance •Strategy/Acquisitions •Technology/Science | Director Qualification Highlights •Senior business leader with a demonstrated track record of leading and growing a global technology-focused business •Experience in accounting/finance, financial reporting, risk assessment, industrial marketing and services, mergers and acquisitions, divestitures and business restructuring, organizational development, governance, strategic planning, corporate development, research and development and manufacturing •Complementary experience and continuing education in corporate governance through his service as the chief executive officer of a public company and on the board of a public company Career Overview •President and Chief Executive Officer of Brady Corporation, a public company, since April 2022. Prior to his current position, Mr. Shaller served as President of the Identification Solutions business at Brady Corporation from 2015 to 2022. Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect people, products and places. •President of Teledyne Microwave Solutions from 2008 to 2015, with responsibility for advanced microwave products sold in the aerospace and communications industry. •Mr. Shaller held a number of positions of increasing responsibility at W.L. Gore & Associates, including Division Leader, Electronic Products Division from 2003 to 2008 and General Manager of Gore Photonics from 2001 to 2003. •Mr. Shaller has previously held positions in engineering and program management at Westinghouse Corporation. . Other Public Company Board Memberships •Current Public Company Boards: Brady Corporation (NYSE: BRC) •Previous Public Company Boards (Past Five Years): None | ||||

2024 Proxy Statement | |||||||

Mark A. Douglas, 55

| Mark A. Douglas | Independent | |||||

Age: 61 Director since: 2013 Committees: Governance (Chair); Sustainability Key Skills and Attributes: •Senior Leadership Experience •Governance •Technology/Science | Director

| |||||

DIRECTOR QUALIFICATION HIGHLIGHTS

| • |

• | Experience in •Complementary experience and continuing education through his service as the chief executive officer of a public company and on the boards of both public and private companies Career Overview •President and Chief Executive Officer of FMC Corporation, a public agricultural sciences company that advances farming through innovative and sustainable crop protection technologies, since June 2020. •President and Chief Operating Officer of FMC from June 2018 until May 2020, President, FMC Agricultural Solutions from October 2012 through May 2018, President, FMC’s Industrial Chemicals Group from January 2011 to September 2012 and Vice President, Global Operations and International Development in 2010. •Mr. Douglas held various senior management positions with Dow Chemical, a leader in specialty chemicals delivering products and solutions to sectors such as electronics, water, energy and coatings, including Vice President, President–Asia, Dow Advanced Materials from April to December 2009. Before that, he was based in Shanghai, China as Corporate Vice President, President–Asia of Rohm and Haas Company, a chemical manufacturing company, from March 2007 to April 2009. •Director of Crop Life International. •Serves on the board of trustees of the Pennsylvania Academy of Fine Arts. Other Public Company Board Memberships •Current Public Company Boards: FMC Corporation (NYSE: FMC) •Previous Public Company Boards (Past Five Years): None |

| Sanjay Hinduja | Independent | ||||

Age: 59 Director since: 2019 Committees: Governance Key Skills and Attributes: •Governance •Organizational Development/Global Organizations •Strategic Planning | Director Qualification Highlights •Extensive experience in accounting/finance, financial reporting, risk assessment, organizational development, global organizations, governance, strategic planning and mergers and acquisitions •Complementary experience and continuing education through his service on the board of private companies Career Overview •Chairman of Gulf Oil International Limited, which is part of the privately controlled Hinduja Group of Companies, since February 2001. •Employed by the Hinduja Group of Companies since January 1988 and has been responsible for leading Gulf Oil’s global strategy and expansion. •Non-Executive Chairman of Gulf Oil Corporation Limited from August 2005 until September 2014. •Director of Gulf Oil International Middle East Limited, Gulf Oil Middle East Limited, Sangam Limited, Gulf Oil Marine Limited, and also serves as the Chairman of Gulf Oil Lubricants India Limited. •Chairman of Houghton International Inc. from January 2013 until its combination with Quaker Chemical Corporation. •Director of Gulf Oil Philippines Inc. from July 1999 through June 2021. •Trustee of the Hinduja Foundation UK, which is responsible for the Hinduja Family philanthropic activities in the UK. Other Public Company Board Memberships •Current Public Company Boards: None •Previous Public Company Boards (Past Five Years): None | ||||

Mr. Douglas has been President, FMC Agricultural Solutions

10 | 2024 Proxy Statement | |||||

William H. Osborne, 58

| CONTINUING DIRECTORS | |||||

| |||||

DIRECTOR QUALIFICATION HIGHLIGHTS

| William H. Osborne | Independent | ||||||

Age: 64 Director since: 2016 Committees: Audit; Compensation and Human Resources (Chair) Key Skills and Attributes: •Senior Leadership Experience •Accounting/Finance, Financial Reporting •Organizational Development/Global Organizations •Manufacturing | Director Qualification Highlights •Over 30 years of | ||||||

• | Seasoned executive with significant experience in accounting/finance, financial reporting, engineering, global manufacturing and quality, industrial sales and marketing, organizational development, global organizations, governance, strategic planning, mergers and acquisitions, divestitures and corporate development | Career Overview •Senior Vice President of Operations and Total Quality and leader of the Manufacturing Council for Boeing Defense, Space & Security (BDS), one of The Boeing Company’s three business units, from May 2020 until October 2022. The Boeing Company is the world’s largest aerospace company and a leading manufacturer of commercial jetliners and defense, space and security systems. •Maintained oversight for Environment, Health & Safety at BDS and led Boeing’s Manufacturing Council from 2020 to 2022, at which time he also served on the Boeing Executive Council. •Senior Vice President, Enterprise Operations at Boeing from May 2018 until April 2020. •Senior Vice President of Global Manufacturing and Quality at Navistar International Corporation, a holding company whose subsidiaries and affiliates produce International® brand commercial and military trucks, from August 2013 to April 2018. •Senior Vice President of Custom Products at Navistar from May 2011 to August 2013. •President and Chief Executive Officer of Federal Signal Corporation, a designer and manufacturer of a suite of products and integrated solutions for municipal, governmental, industrial and airport customers, from September 2008 to October 2010. . Other Public Company Board Memberships •Current Public Company Boards: Armstrong World Industries, Inc. (NYSE: AWI) and Invitae Corporation (NYSE: NVTA) •Previous Public Company Boards (Past Five Years): None |

Mr. Osborne has been Senior Vice President of Global Manufacturing and Quality at Navistar International Corporation, a holding company whose subsidiaries and affiliates produce International® brand commercial and military trucks, since August 2013. He previously served as Senior Vice President of Custom Products at Navistar from May 2011 to August 2013. Before joining Navistar, he served as President and Chief Executive Officer of Federal Signal Corporation, a designer and manufacturer of a suite of products and integrated solutions for municipal, governmental, industrial and airport customers, from September 2008 to October 2010.

| Fay West | Independent | |||||

Age: 55 Director since: 2016 Committees: Audit (Chair); Governance Key Skills and Attributes: •Senior Leadership Experience •Accounting/Finance, Financial Reporting •Risk Assessment •Governance | ||||||

Fay West, 49

| Director

Qualification Highlights •Extensive experience in accounting/finance, financial reporting, risk assessment, industrial marketing and services, mergers and acquisitions, divestitures and business restructuring, global organizations, governance, corporate development and manufacturing •Complementary experience and education in corporate governance through her prior service on the board of another public company Career Overview •Senior Vice President and Chief Financial Officer of Tennant Company, a world leader in the design, manufacture, and marketing of solutions that help create a cleaner, safer, healthier world, since April 2021. •Senior Vice President and Chief Financial Officer of SunCoke Energy, Inc., the largest independent producer of coke in the Americas, from October 2014 until April 2021. •Senior Vice President and Chief Financial Officer of SunCoke Energy Partners, L.P., a publicly traded master limited partnership that manufactures coke used in the blast furnace production of steel and provides coal handling services to the coke, steel and power industries, from October 2014 until its merger with SunCoke Energy Partners GP LLC in January 2020. •Assistant Controller at United Continental Holdings, Inc., an airline holding company, from April 2010 to January 2011. . Other Public Company Board Memberships •Current Public Company Boards: None •Previous Public Company Boards (Past Five Years): SunCoke Energy Partners, L.P. (NYSE: SXCP) (from October 2014 until June 2019) |

DIRECTOR QUALIFICATION HIGHLIGHTS

2024 Proxy Statement | 11 | ||||||||

Ms. West has, since October 2014, been Senior Vice President and Chief Financial Officer

| CONTINUING DIRECTORS | |||||||

Mr. Barry is being nominated to fill a vacancy in Class II. If Mr. Barry is not elected to serve as a Class II director, he will continue to serve as a Class I director. Information regarding Mr. Barry is presented above with the other Class II nominees.

Robert E. Chappell, 73

| Charlotte C. Henry | Independent | |||||

Age: 59 Director since: 2020 Committees: Audit; Governance Key Skills and Attributes: •Senior Leadership Experience •Accounting/Finance, Financial Reporting •Governance | Director

•Over 25 years of broad information technology experience across several major industries •Extensive experience in cybersecurity and information technology, including as the Chair of the Information Technology Committee

| |||||

DIRECTOR QUALIFICATION HIGHLIGHTS

| • | Experience in |

| acquisitions, technology and science, and manufacturing • | Career Overview •Chief Information Technology Officer of the UAW Retiree Medical Benefits Trust, the largest non-governmental purchaser of retiree health care in the United States, covering over 632,300 members, from December 2014 to February 2022. •IT Management Consultant at Data Consulting Group (DCG), a privately held, minority-owned corporation offering a wide range of management consulting, staff augmentation and outsourcing services, from August 2014 until December 2015. •Vice President and Chief Technology Officer of Auto Club Group, a not-for-profit organization, which provides more than 59 million members with automotive, travel, insurance and financial services through its federation of 34 motor clubs and nearly 1,100 branch offices across North America, from September 2008 through June 2014. •Over 25 years of information technology experience through various leadership positions, including 18 years at Ford and General Motors. Both Ford and General Motors are multinational corporations that design, manufacture, market and distribute vehicles worldwide. . Other Public Company Board Memberships •Current Public Company Boards: Federal Home Loan Bank of Indianapolis •Previous Public Company Boards (Past Five Years): None |

Mr. Chappell was the Chairman of The Penn Mutual Life Insurance Company, a mutual life insurance company providing life insurance and annuity products, from January 1997 to June 2013 when he retired; its Chief Executive Officer from April 1995 to February 2011; and its President from January 2008 to March 2010. Mr. Chappell currently serves as a director of CSS Industries, Inc. and as a trustee of The Penn Mutual Life Insurance Company.

Robert H. Rock, 67

| Ramaswami Seshasayee | Independent | |||||

Age: 75 Director since: 2019 Committees: Audit; Compensation and Human Resources Key Skills and Attributes: •Senior Leadership Experience •Accounting/Finance, Financial Reporting •Risk Assessment | Director

| |||||

DIRECTOR QUALIFICATION HIGHLIGHTS

| • | •Extensive experience in the transportation industry •Complementary experience and continuing education in corporate |

Career Overview •Managing Director and | Chief Executive Officer at Ashok Leyland Limited, India, a company reported to be the second largest manufacturer of commercial vehicles in India, the fourth largest manufacturer of buses in the world and the twelfth largest manufacturer of trucks, from April 1998 to March 2011. •Executive Vice Chairman of Ashok Leyland from April 2011 until March 2013 and its Non-Executive Vice Chairman from April 2013 until July 2016. •Chairman of Asian Paints, Ltd. •Chairman of IndusInd Bank Ltd. India from June 2007 until August 2019. •Director of Houghton International Inc., from April 2013 until its combination with Quaker Chemical Corporation. . Other Public Company Board Memberships •Current Public Company Boards: None •Previous Public Company Boards (Past Five Years): None |

Mr. Rock has been Chairman and Chief Executive Officer

12 | 2024 Proxy Statement | |||||

Andrew E. Tometich Chief Executive Officer and President | Not Independent | ||||

Age: 57 Director since: 2021 Committees: None Key Skills and Attributes: •Senior Leadership Experience •Risk Assessment •Organizational Development/Global Organizations •Strategic Planning/M&A | Director Qualification Highlights •Extensive and valuable experience acquired through his critical leadership position with Quaker Houghton and other prior senior leadership roles •Extensive knowledge of accounting/finance, financial reporting, risk assessment, industrial marketing and services, organizational development, global organizations, governance, strategic planning, mergers and acquisitions, technology and science, corporate development, research and development and manufacturing Career Overview •Chief Executive Officer and President of Quaker Houghton since December 2021. •Executive Vice President, Hygiene, Health and Consumable Adhesives at H.B. Fuller Company, a leading global adhesives provider focusing on perfecting adhesives, sealants, and other specialty chemical products to improve products and lives, from August 2019 until September 2021. •Senior Vice President, Specialty Materials Business at Corning Incorporated, one of the world’s leading innovators in materials science with deep manufacturing and engineering capabilities from September 2017 until August 2019. •President, Performance Silicones Business Unit at The Dow Chemical Company, a leader in specialty chemicals, from June 2016 until February 2017 after having positions of increasing responsibility at Dow Corning Corporation and its subsidiaries from 1989 through 2016. •Director of the American Chemistry Council. •Director and Executive Committee member of the Society of Chemical Industry (SCI). . Other Public Company Board Memberships •Current Public Company Boards: None •Previous Public Company Boards (Past Five Years): None | ||||

2024 Proxy Statement | | |||||

Quaker’s

the Company continues on its strategic growth plans.

On an annual basis, each

who had served on the Board until their retirement on May 10, 2023, were also independent non-employee directors. Based on the Company’s independence standards, the Board has affirmatively determined that Michael F. Barry is not independent because he previously served as an executive officer of the Company, Andrew E. Tometich is not independent because he currently serves as an executive officer of the Company.Company and Michael J. Shannon is not independent because he previously served as an executive officer of Houghton International Inc. There are no family relationships between any of the Quaker Houghton directors, executive officers or nominees for election as directors.

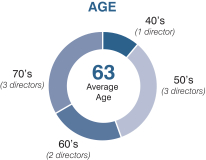

Quaker’sQuaker Houghton’s Board includes ninecurrently consists of eleven directors who are or have served as chief executive officers or in other executive management roles, seveneleven directors with specialized accounting and finance knowledge, fournine directors with experience in the chemical industry or other technology or science areas, eightone director with experience in cybersecurity, two directors with experience understanding and managing environmental risk, nine directors who have served on the boards of other public companies, nineten directors with internationalglobal business experience and fiveseven directors with experience in industries served by Quaker.Quaker Houghton. The Governance Committee will continue to evaluate the needs of Quaker Houghton and its shareholders to ensure that the competencycompetencies of the Board, as a whole, isare relevant and robust.

14 | 2024 Proxy Statement | |||||

| CORPORATE GOVERNANCE | |||||

Under Quaker’s

|

The following chart summarizes the core competencies currently represented on our Board.

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

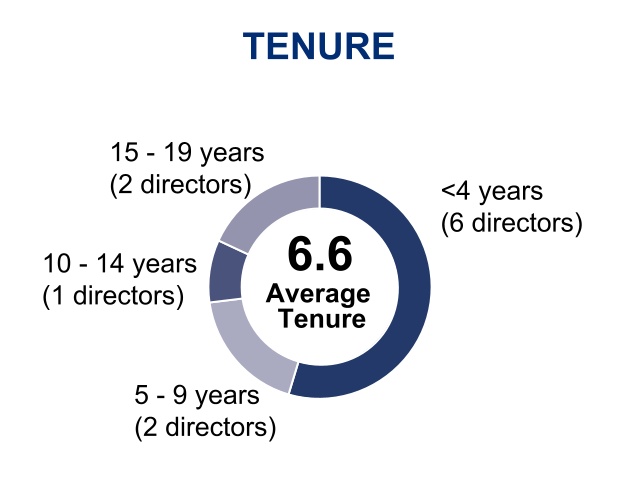

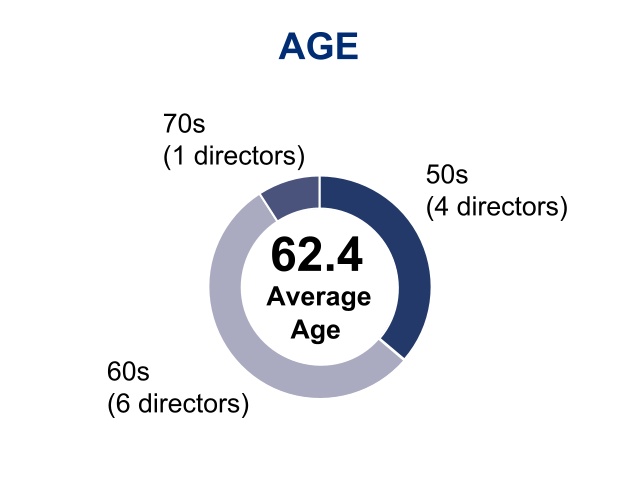

Currently, forty-five percent (45%) of our Board is comprised of directors who self-identify as minorities or persons of color, and women. The Board and the Governance Committee are committed to assembling and maintaining a qualified and diverse group of Board members. As part of that goal, the Board and the Governance Committee currently are actively seeking new board candidates and aiming to increase gender diversity on the Board.

2024 Proxy Statement | 15 | |||||

| CORPORATE GOVERNANCE | |||||

| Barry | Douglas | Frisby | Henry | Hinduja | Osborne | Seshasayee | Shaller | Shannon | Tometich | West | ||||||||||||||||||||||||||||

| DEMOGRAPHICS | ||||||||||||||||||||||||||||||||||||||

| Woman | X | X | ||||||||||||||||||||||||||||||||||||

| African- American/ Black | X | X | ||||||||||||||||||||||||||||||||||||

| Pan – Asian | X | X | ||||||||||||||||||||||||||||||||||||

| Non – U.S. Resident | X | X | ||||||||||||||||||||||||||||||||||||

| SKILLS & EXPERIENCE | ||||||||||||||||||||||||||||||||||||||

Senior Leadership Service as CEOs or in other executive management roles, with experience on matters relating to corporate governance, management and operations. | X | X | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||

Accounting/Finance/Financial Reporting Specialized accounting and finance knowledge. | X | X | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||

Risk Assessment Experience in the management of critical business and/or legal risk and an understanding of risk management functions, including risk identification/classification, crisis management and similar functions, along with the ability to think strategically about risk and provide oversight and advice relating to risk. | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||

Industrial Marketing Experience with business-to-business marketing and relevant understanding of the Company’s products and services. | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||

Industrial Service Operations Deep understanding of our business, strategy and marketplace dynamics. | X | X | X | X | X | |||||||||||||||||||||||||||||||||

Organizational Development/Global Broad exposure to companies or organizations that have a significant global presence, including developing and managing business in markets around the world. | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||

Governance Experience with reporting obligations, investor interaction, public company governance, knowledge and understanding of governance planning, and experience in encouraging management accountability and protecting shareholder interests. | X | X | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||

Strategy/Acquisitions Experience in and understanding of business development, strategic planning, and implementation; experience in leading strategy discussion at the board level; experience with developing and implementing strategies for growth, including mergers and acquisitions and divestitures. | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||

Technology/Science Experience identifying and capturing new technological advances applicable to our business and experience managing innovations and R&D. | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||

Manufacturing Experience in the industry and markets served by the Company offer valuable perspective for business operations and global supply chain. | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||

Cybersecurity Experience in overseeing and managing cybersecurity and data privacy risks; history of leadership roles in cybersecurity risk management; degrees, certifications, or other background in cybersecurity. | X | |||||||||||||||||||||||||||||||||||||

Environmental Matters An understanding of effective management and disclosure of environmental risks and opportunities is essential to ensure appropriate oversight and create long-term value for our stakeholders. | X | X | ||||||||||||||||||||||||||||||||||||

16 | 2024 Proxy Statement | |||||

| CORPORATE GOVERNANCE | |||||

|  |

The notice to our Corporate Secretary must contain or be accompanied by the information required by Sections 3.15 and 2.13 of our By-Laws, including, among other things: (i) the name, age, principal occupation and business and residence address of each person nominated; (ii) the class and number of shares of our stock which are directly or indirectly owned beneficially and/or of record by each person nominated; (iii) the name and record address of the shareholder making the nomination and the beneficial owner, if any, on whose behalf the nomination is made; (iv) the class and number of shares of our stock which are directly or indirectly owned beneficially and/or of record by the shareholder making the nomination and the beneficial owner, if any, on whose behalf the nomination is made; (v) a description of any direct and indirect compensation and other monetary agreements, arrangements and understandings during the past three years, and any other material relationships (including any familial relationships) between the shareholder giving notice (and the beneficial owner) and the nominee and any respective affiliates, associates or others with whom any of them are acting; and (vi) a description of any hedging or other transaction that has been entered into by or on behalf of, or any other agreement or understanding (including, without limitation, any put, short position or any borrowing or lending of shares) that has been made, the effect or intent of which is to mitigate loss to or manage risk of share price changes for, or to increase or decrease the voting power of, the shareholder or any shareholder associated person (as defined in the By-Laws) with respect to any share of our stock, as well as certain other information.information; (vii) a representation as to whether or not the shareholder intends to solicit proxies in support of director nominees other than the Company’s nominees in accordance with Section 14a-19 under the Securities Exchange Act of 1934, as amended; and (viii) a fully completed questionnaire with respect to the background and qualifications of the nominee and a written representation agreement of the nominee (each in the form provided by the Corporate Secretary upon request). This list of required information is not exhaustive. A copy of the full text of the relevant By-Law provisions, which includes the complete list of all information that must be submitted to nominate a director, may be obtained upon written request directed to our Corporate Secretary at our principal office. A copy of our By-Laws is also posted on the Investor Relations/Investors/Corporate Governance section of our website athttps://www.quakerchem.com.

www.quakerhoughton.com.

2024 Proxy Statement | 17 | |||||

| CORPORATE GOVERNANCE | |||||

While

In addition, the Compensation/Management Development Committee is responsible for developing a balanced compensation system for all employees, including appropriate long-term and short-term incentive compensation targets that encourage a level of risk-taking behavior consistent with the overall financial/strategic goals of the Company, as well as oversight of the management, development and succession processes. Finally, from time to time, Quaker faces other risks material to its business and, in those

| Committee | Primary Area of Risk Oversight Responsibility | |||||

| •Oversees financial risks, such as those relating to financial reporting and internal controls •Oversees compliance risks, including oversight of our compliance program and disposition of certain complaints and/or violations of our Code of Conduct and Financial Code of Ethics for Senior Financial Officers •Oversees operational risk, such as loss of property, cyber-security, business interruption and other exposures traditionally mitigated through insurance products. Charlotte C. Henry, a member of the Audit Committee, has cybersecurity experience gained through over 25 years of work experience in information technology | |||||

| Compensation and Human Resources Committee | •Maintains responsibility for developing a balanced compensation system for all employees, including appropriate long-term and short-term incentive compensation targets that encourage an appropriate (and not excessive) level of risk-taking behavior consistent with the overall financial and strategic goals of the Company •Oversees the talent management, retention, development and succession process | |||||

| Sustainability Committee | •Maintains responsibility for monitoring and evaluating our approach to sustainability and oversees the integration of sustainability planning, including with regards to climate-related risks and opportunities, into the Company’s business planning and strategy, risk management process and culture •Oversees the risks that are potentially implicated in sustainability matters | |||||

18 | 2024 Proxy Statement | |||||

| CORPORATE GOVERNANCE | |||||

circumstances, the Board (or at times, the Executive Committee) is regularly informed and provides input and advice on actions being considered to mitigate exposures associated with those risks. As appropriate, the Board considers specific risk topics, including risks associated with our strategic plan, our capital structure and our development activities. Further, the Board is routinely informed of developments at and affecting the Company that could affect our risk profile or other aspects of our business through reports from our business units and otherwise. This oversight by the Board is designed to maintain an appropriate level of risk and to address new risks as they arise.

Any employee, shareholder or other interested party can call the Quaker Houghton Hotline, at 1-800-869-9414 or1-678-999-4552 from outside the United States. The Quaker Hotlinewhich is a set of country- specific toll-free telephone linelines dedicated solely to receiving questions and concerns and directing them to the appropriate authority for action. All calls are answered by an independent third-party service available 24 hours a day, seven days a week.

Alternatively, any employee, shareholder or other interested party may report such activity or issues via www.integritycounts.ca/org/quakerhoughton, an independent third-party provider. At that website, an interested party will be provided with a case number, which will allow the individual to request a follow-up. To further track the case, one may also request a login and password, which will allow the individual to follow-up on the case as necessary.

2024 Proxy Statement | 19 | |||||

| CORPORATE GOVERNANCE | |||||

20 | 2024 Proxy Statement | |||||

| CORPORATE GOVERNANCE | |||||

2024 Proxy Statement | 21 | |||||

| CORPORATE GOVERNANCE | |||||

22 | 2024 Proxy Statement | |||||

| CORPORATE GOVERNANCE | |||||

2024 Proxy Statement | | |||||

| Committee Membership and Meetings Held in 2017 | ||||||||

| Name | Audit | Compensation/ Management Development | Executive | Governance | ||||

Michael F. Barry | X | |||||||

Donald R. Caldwell | X | X | CHAIR | |||||

Robert E. Chappell | X | CHAIR | ||||||

William R. Cook | CHAIR | X | X | |||||

Mark A. Douglas | X | X | ||||||

Jeffry D. Frisby | X | X | ||||||

William H. Osborne | X | X | ||||||

Robert H. Rock | CHAIR | X | ||||||

Fay West | X | |||||||

Number of Meetings in 2017(1) | 5 | 5 | 0 | 3 | ||||

| Committee Membership and Meetings Held in 2023 | ||||||||||||||

| Name | Audit | Compensation and Human Resources | Governance | Sustainability | ||||||||||

| Michael F. Barry | X | |||||||||||||

Donald R. Caldwell(6) | X(1) | X(1) | ||||||||||||

| Mark A. Douglas | CHAIR | X | ||||||||||||

| Jeffry D. Frisby | X | CHAIR(3) | ||||||||||||

| Charlotte C. Henry | X | X | ||||||||||||

| Sanjay Hinduja | X | |||||||||||||

| William H. Osborne | X | CHAIR(2) | X(1) | |||||||||||

Robert H. Rock(6) | CHAIR(3) | X(1) | ||||||||||||

| Ramaswami Seshasayee | X | X | ||||||||||||

Russell R. Shaller(4) | X | X | ||||||||||||

| Michael J. Shannon | CHAIR(2) | |||||||||||||

| Fay West | CHAIR | X | ||||||||||||

Number of Meetings in 2023(5) | 7 | 5 | 3 | 3 | ||||||||||

| X | Member. Each of the individuals listed in the table above held the committee memberships indicated throughout | ||||

| (1) | Committee member until May 10, 2023. | ||||

| (2) | Chair since May 10, 2023. | ||||

| (3) | Chair until May 10, 2023. | ||||

| (4) | Mr. Shaller was appointed as a director on July 26, 2023. He was also appointed to the Audit and Compensation and Human Resources Committees on July 26, 2023. | ||||

| (5) | The Board of Directors held five | ||||

| (6) | Donald R. Caldwell and Robert H. Rock retired effective with the |

24 | 2024 Proxy Statement | |||||

the executive session of independent directors.

Compensation/Management Developmentmanagement’sthe Company’s Total Rewards and Human Capital programs to ensure alignment with business strategy, Company culture and diversity and inclusion philosophy. Provides recommendations to the Board.philosophies and policies.Approves annual performance objectives forof the CEO evaluates the CEO’sand executives including annual, short-term and long-term incentive programs, performance targets and achievements against objectives, and makes a recommendationto make recommendations to the Board regarding the CEO’s base salary.compensation. performance evaluations and approves annual salaries for all executive officers, other than the CEO.design and structure of incentive-based compensation plans and equity-based plans.Approves annual incentive and long-term incentive award opportunities for all executive officers, including the CEO.Administers Quaker’s Global Annual Incentive Plan and Long-Term Performance Incentive Plan.evaluates management developmentapproves any severance arrangements, change-in-control agreements, equity awards, or special or supplemental benefits in relation to an employment agreement for executives and succession planning and oversees these processes.to make recommendations to the Board regarding the CEO.

2024 Proxy Statement | 25 | |||||

| COMMITTEES | |||||

The Audit Committee,

| 26 | 2024 Proxy Statement | ||||||

2024 Proxy Statement | |||||||

section and the accompanying compensation tables and other narrative disclosures contained in this proxy statement. Because your vote is advisory, it will not be binding on the Board or the Company. However, the Board will review the voting results and take these results into consideration when making future decisions regarding executive compensation for Quaker Houghton’s management team.

28 | 2024 Proxy Statement | |||||

| PROPOSAL 2 | |||||

2024 Proxy Statement | 29 | |||||

| PROPOSAL 3 | ||||||||

| Year | Awards Granted | Basic Weighted Average Common Stock Outstanding as of 12/31 | Burn Rate | |||||||||||||||||

| Stock Options | Restricted Stock/RSUs | PSUs(1) | Total | |||||||||||||||||

| 2023 | — | 49,683 | 34,054 | 83,737 | 17,892,461 | 0.47% | ||||||||||||||

| 2022 | 31,914 | 65,136 | 18,462 | 115,512 | 17,841,487 | 0.65% | ||||||||||||||

| 2021 | 25,250 | 26,327 | 15,878 | 67,455 | 17,805,034 | 0.38% | ||||||||||||||

| Three-Year Average Historical Burn Rate | 0.50% | |||||||||||||||||||

| Category | # of Shares | Dilution | ||||||

| Outstanding Awards | 218,180 | 1.21% | ||||||

| Shares Remaining for Future Issuance under the 2016 LTIP | 81,390 | 0.45% | ||||||

| Proposed 2024 Share Request under the Restated Plan | 900,000 | 5.00% | ||||||

| Total | 1,199,570 | 6.66% | ||||||

30 | 2024 Proxy Statement | |||||

| PROPOSAL 3 | |||||

2024 Proxy Statement | 31 | |||||

| PROPOSAL 3 | |||||

32 | 2024 Proxy Statement | |||||

| PROPOSAL 3 | |||||

2024 Proxy Statement | 33 | |||||

| PROPOSAL 3 | |||||

| Name | Number of PSUs, restricted stock, restricted stock units, and options granted (#) | ||||

| Andrew E. Tometich | 12,107 | ||||

| Shane W. Hostetter | 3,103 | ||||

| Joseph A. Berquist | 3,880 | ||||

| Jeewat Bijlani | 3,603 | ||||

| Melissa Leneis | 4,435 | ||||

| All executive officers as a group | 40,249 | ||||

| All non-executive directors as a group | 6,598 | ||||

| All employees, excluding executive officers and non-executive directors | 36,890 | ||||

| Total | 83,737 | ||||

34 | 2024 Proxy Statement | |||||

| EXECUTIVE COMPENSATION | ||||||||

Quaker’s Compensation/Management DevelopmentHuman Resources Committee (the “Committee”) has implementedreviews and approves our executive compensation programs designedprograms. The following discussion and analysis describes the material elements of compensation awarded to, reward performance. earned by or paid to our executive officers, including our named executive officers (our “NEOs”), during fiscal year 2023. Our NEOs are determined in accordance with SEC rules. For fiscal 2023, our NEOs were:

| The Compensation Discussion and Analysis is organized into the following sections: | |||||||||||||||||

| Andrew E. Tometich Chief Executive Officer and President | ||||||||||||||||

| Shane W. Hostetter Executive Vice President, Chief Financial Officer | ||||||||||||||||

| Joseph A. Berquist Executive Vice President, Chief Commercial Officer | ||||||||||||||||

| Jeewat Bijlani Executive Vice President, Chief Strategy Officer | ||||||||||||||||

| Melissa Leneis Executive Vice President, Chief Human Resources Officer | ||||||||||||||||

2024 Proxy Statement | 35 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

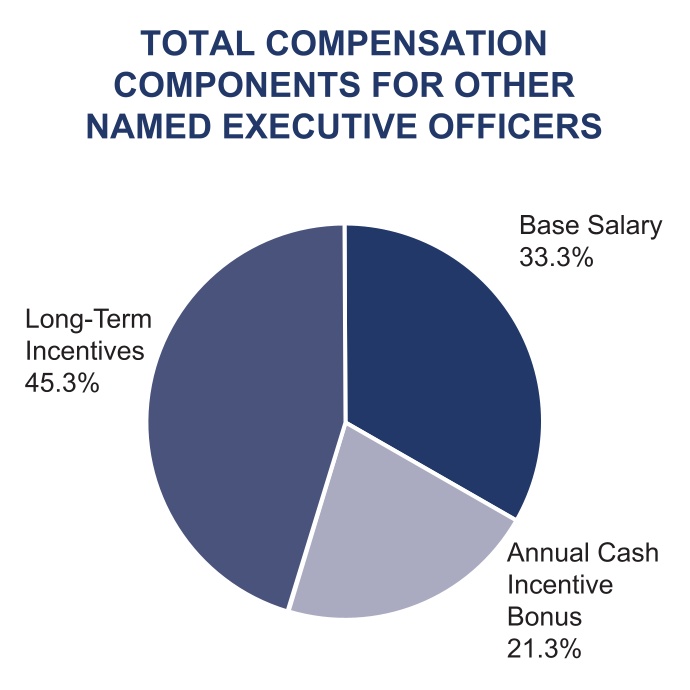

orientation and has implemented executive compensation programs designed to incentivize high performance. We compensate our executive officers (including our NEOs) through a total compensation package. For 2023, this package consisted of a mix of base salary, an annual cash incentive bonus under our Annual Incentive Plan (the “AIP”), long-term equity award incentives under our long-term performance incentive plan (the “LTIP”) and a competitive benefits package comprising of medical, life, disability and retirement components using both qualified and non-qualified programs, where appropriate.

operating cash flow of $279 million.

In making decisions about fiscal 2017 salaries and performance targets, the Committee also considered fiscal 2016 corporate performance. Factors affecting the key components

Quaker’s Stock Performance. Long-term incentives make up a

36 | 2024 Proxy Statement | |||||

|

Quaker’s overall compensation strategy and specific programs have not changed over the past several years as we have strived to maintain a consistent year-over-year approach to ensure thatCompensation. At our compensation remains predictable and competitive to the market, as well as fair and reasonable. In particular, we have continued to:

Consistent with this approach, we have sought and have received approval from our shareholders regarding incentive plans that are used to attract, motivate, retain and reward our executives. In fact, when two of our incentive plans were presented to the shareholders for approval at the 2016 annual meeting of shareholders they overwhelmingly approved both plans.

The Committee continually reviews our executive compensation programs to ensure they achieve the desired goals of aligning our compensation practices to performance and pay practicesheld in the Company’s industry and prudent risk taking to achieve sustainable shareholder value creation. The Committee has again determined that the Company’s current compensation programs are not likely to encourage excessive risk taking because the metrics in the Company’s compensation plans are linked to corporate performance as it relates to set budgetary targets and because the plans are measured against identified peer comparison groups.

In addition, at the Company’s 2017 annual meeting of shareholders, the shareholders overwhelmingly voted, on an advisory basis, to approve the Company’s compensation of our Named Executive Officers. At the same 2017 annual meeting of shareholders, the shareholders also voted to recommendMay 2023, we held an advisory vote on executive compensation. Approximately 97% of our shareholders that voted on this proposal approved the Company’s compensation once every three yearsof our NEOs as disclosed in the proxy statement for that meeting. The Committee reviewed these final vote results and determined that, given the Company has followed this recommendation. Given the significant level of support, received in the 2017 advisory vote, the Board of Directors and Committee have not made anyno material changes to our executive compensation policies and decisions sinceprograms were necessary as a result of the advisory vote on executive compensation.

the following executive compensation-related practices, which were in effect during fiscal 2023, serve our shareholders’ long-term interests:

| What We Do | What We Don’t Do | |||||||||||||

| ☑ | Link executive pay to performance through our annual and long-term incentive plans | ☒ | Provide tax gross-ups or single-trigger equity acceleration upon a change of control | |||||||||||

| ☑ | Structure a significant portion of pay opportunities in the form of “at-risk” performance-based compensation | ☒ | Provide excessive perquisites | |||||||||||

| ☑ | Maintain robust stock ownership guidelines applicable to executive officers and directors | ☒ | Offer single-trigger change of control severance payments (our arrangements are double-trigger) | |||||||||||

| ☑ | Conduct an annual say-on-pay vote | ☒ | Allow backdating or repricing of stock options | |||||||||||

| ☑ | Maintain a compensation recoupment policy to recapture unearned incentive pay | ☒ | Offer supplemental executive retirement plans | |||||||||||

| ☑ | Retain an independent compensation consultant | ☒ | Permit hedging and pledging transactions by directors or executive officers | |||||||||||

| ☑ | Periodically conduct a compensation risk review | ☒ | Adopt pay policies or practices that pose material adverse risk to the Company | |||||||||||

| ☒ | Provide guaranteed bonuses | |||||||||||||

To attract and retain talented senior level managers, we have adopted a compensation approach that:

2024 Proxy Statement | 37 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

| Alignment | Attraction & Retention | Line of Sight | ||||||||||||

•Compensation that is directly aligned with shareholder value creation, and with driving company and individual performance •Allowing participants to share in the successes and failures of the organization •Encouraging desired behaviors | •Providing competitive total compensation opportunities •Providing compensation that holds value •Providing greater flexibility to substantially reward “star” performers | •Providing a clear path between the company’s strategic objectives and the ability for the participant to play a role in achieving them •Empowering participants by using compensation performance metrics that are within their control to achieve | ||||||||||||

38| | ||||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

Quaker compensates its executive officers (who for 2017 include our Chairman, CEO and President and our vice presidents) through a total compensation package. This package consists of a mix of base salary, an annual cash incentive bonus, long-term incentives comprising both equity awards and cash payments and a competitive benefits package comprising medical, life, disability and retirement using both qualified and non-qualified programs, where appropriate.

To the extent possible, the Committee seeks to structure theGovernance.

Houghton.

|

management, rewards, and risk and capital management, as an independent consultant on compensation issues. Management had no role in selecting the Committee’s compensation consultant. In addition, Towers WatsonWTW has, from time to time, provided the Committee with executive compensation studies and analyses, as well as benchmarking data and counsel on compensation issues as needed or desired.

Towers Watson provided no other services to the Company in fiscal 2017 other than advising the Committee on various executive compensation matters (including providing some advice and peer group data to the Committee regarding the compensation for the new Executive Leadership Team to be formed as part of the anticipated combination with Houghton) and advising the Governance Committee on board compensation matters as further discussed below. Management had no role in selecting the Committee’s compensation consultant.

Peer Group Companies(1) | |||||

| Ashland Global Holdings Inc. (ASH) | Ingevity Corporation (NGVT) | ||||

| Avient Corporation (AVNT) | Innospec Inc. (IOSP) | ||||

| Axalta Coating Systems Ltd. (AXTA) | Minerals Technologies Inc. (MTX) | ||||

| Balchem Corp (BCPC) | NewMarket Corporation (NEU) | ||||

| Diversey Holdings, Ltd. (DSEY) | Rayonier Inc. (RYN) | ||||

| Element Solutions Inc (ESI) | Sensient Technologies Corporation (SXT) | ||||

| GCP Applied Technologies, Inc. (GCP) | Stepan Company (SCL) | ||||

| H.B. Fuller Company (FUL) | |||||

2024 Proxy Statement | 39 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

W. R. Grace & Co.

discretion.

Program

general philosophy, these guidelines provide that the higher the position within management the more the executive’s total compensation is dependent on incentive pay and the more the executive’s incentive pay is equity-based and long-term oriented. This is donedesign aims to better align senior levelexecutives’ compensation with the long-term success of the Company.Company and with the interests of shareholders. These guidelines are reviewed regularly to ensure their marketplace competitiveness.

In the case

| Pay Element | Objectives | Features | ||||||||||||

| Base Salary | Provide a fixed level of cash compensation for performing day-to-day responsibilities | Based on individual’s role, duties, responsibilities, experience, performance and financial results | ||||||||||||

| Annual Incentive Plan (AIP) | Reward achievement of short-term financial, strategic and individual performance goals | Cash payments based on achievement of our; (1) Adjusted EBITDA, (2) New Business Wins, and (3) ESG: Safety performance goals. An individual performance component is also considered. | ||||||||||||

| Long-Term Performance Incentive Plan (LTIP) | Align management interests with those of shareholders, encourage retention and reward long-term Company performance | Consists of: •60% performance-based share units, based on equal parts; (1) relative total shareholder return, and (2) adjusted return on invested capital •40% time-based restricted stock, vesting ratably over a three-year period | ||||||||||||

40 | 2024 Proxy Statement | |||||

| Named Executive Officer | Initial Base Salary Rate ($) | New Base Salary Rate ($) | Base Salary Received ($) | |||||||||

Mary Dean Hall | 355,250 | 370,000 | 367,164 | |||||||||

D. Jeffry Benoliel | 352,331 | 359,378 | 358,023 | |||||||||

Wilbert Platzer(1) | 296,487 | 302,417 | 301,429 | |||||||||

Joseph A. Berquist | 315,315 | 331,081 | 328,049 | |||||||||

| Named Executive Officer | Initial 2023 Base Salary Rate ($) | New 2023 Base Salary Rate ($) | 2023 Year-End Total Base Salary Received ($) | ||||||||

Shane W. Hostetter (2) | 413,400 | 455,000 | 447,480 | ||||||||

Joseph A. Berquist (2) | 517,500 | 540,000 | 535,933 | ||||||||

Jeewat Bijlani(1) | 500,000 | 500,000 | 500,000 | ||||||||

Melissa Leneis(2) | 455,000 | 485,000 | 479,577 | ||||||||

The maximum bonus that an eligible associate may earn under the GAIPtransparency of how rewards are calculated; and

| Name | 2023 Base Salary Level ($) | 2023 AIP Target (% of Base Salary) | 2023 AIP Payout Range (% of 2023 AIP Target) | 2023 AIP Target Award ($) | Actual 2023 AIP Award ($) | ||||||||||||

| Andrew E. Tometich | 880,000 | 100% | 0-200% | 880,000 | 1,430,000 | ||||||||||||

| Shane W. Hostetter | 455,000 | 65% | 0-200% | 295,750 | 384,475 | ||||||||||||

| Joseph A. Berquist | 540,000 | 65% | 0-200% | 351,000 | 570,375 | ||||||||||||

| Jeewat Bijlani | 500,000 | 65% | 0-200% | 325,000 | 528,125 | ||||||||||||

| Melissa Leneis | 485,000 | 65% | 0-200% | 315,250 | 512,281 | ||||||||||||

2024 Proxy Statement | 41 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

| 2023 AIP Performance Metrics | ||||||||||||||

| Award Measure | Weight | Award Parameters as a % of Goal Board Discretion to pay between 0-200% of Target | ||||||||||||

| Metric | By Metric | Minimum Threshold Performance Payout 50% of Target | Target Performance Payout 100% | Maximum Performance Payout 200% of Target | ||||||||||

| Financial | 60% | $260m | $314m | $350m | ||||||||||

| New Business | 25% | 2% | 3% | 4% | ||||||||||

| ESG: Safety (TRIR) | 15% | 0.40 | 0.28 | 0.20 | ||||||||||

| Total | 100% | |||||||||||||

| Individual Performance will be applied as a multiplicative, with payout aligned to performance rating, and an individual payout maximum of 200% of target. | ||||||||||||||

| 2022 Metrics | AIP | → | 2023 Metrics | AIP | ||||||||||

| EBITDA (or EBITDA/Profit Before Tax) | 60% | Adjusted EBITDA | 60% | |||||||||||

| Net New Business | 10% | New Business | 25% | |||||||||||

| ESG | 10% | ESG: Safety (TRIR) | 15% | |||||||||||

| Safety | 10% | Total % | 100% | |||||||||||

| Individual Performance | 10% | Multiplied by Individual Performance Modifier (Maximum payout of 200%) | ||||||||||||

| Target % | 100% | |||||||||||||

| Award Parameters | Payout | ||||||||

| $260m | ||||||||

| $314m | If Adjusted EBITDA is at Target; payout will be 100% of Target | |||||||

| Maximum Performance | $350m | If Adjusted EBITDA is at or above maximum; payout will be 200% of Target | ||||||

regional objectivesNote: Interpolation is used for regional associates (Messrs. Berquistmeasuring achievement between threshold and Platzer)target and individual objectives for non-regional associates (Messrs. Barrybetween target and Benoliel and Ms. Hall). Regional executive officers havemaximum.

42 | 2024 Proxy Statement | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

| Award Parameters | Payout | |||||||

| Minimum Threshold Performance | 2% | If actual NBW is less than minimum threshold; payout will be 0% of Target If actual NBW is at minimum threshold; payout will be 50% of Target | ||||||

| Target Performance | 3% | If actual NBW is at Target; payout will be 100% of Target | ||||||

| Maximum Performance | 4% | If actual NBW is at or above maximum; payout will be 200% of Target | ||||||

| Award Parameters | Payout | |||||||

| Minimum Threshold OII/TRIR | 0.40 | If OII/TRIR is at minimum threshold; payout will be 50% of Target | ||||||

| Target OII/TRIR | 0.28 | If OII/TRIR is at Target; payout will be 100% of Target | ||||||

| Maximum OII/TRIR | 0.20 | If actual OII/TRIR is at or above maximum; payout will be 200% of Target | ||||||

The following chart shows, as a percentage of base salary, the maximum potential bonus and the bonus amounts payable on target achievement and maximum achievement, allocated between corporate and individual objectives for 2017. The table also shows the percentage and amount of base salary actually paid as a result of achievement during 2017.

Named Executive Officer

| Maximum

|

Corporate Financial Objectives | Individual Objectives (as a % of base salary) | Total Earned and

| ||||||||||||||||||||||||||||

| Target | Maximum | Achieved(2) | Target | Maximum(1) | Achieved(3) | |||||||||||||||||||||||||||

Michael F. Barry | 182 | (4) | 75.08 | 156.98 | 86.00 | 25.03 | N/A | 25.03 | 915,915 | |||||||||||||||||||||||

Mary Dean Hall | 85 | 35.06 | 73.31 | 40.16 | 11.69 | N/A | 11.69 | 191,845 | ||||||||||||||||||||||||

D. Jeffry Benoliel | 85 | 35.06 | 73.31 | 40.16 | 11.69 | N/A | 11.69 | 186,337 | ||||||||||||||||||||||||

Wilbert Platzer | 85 | 35.06 | 73.31 | 40.16 | 11.69 | 21.25 | 13.79 | (5) | 163,165 | |||||||||||||||||||||||

Joseph A. Berquist | 85 | 35.06 | 73.31 | 40.16 | 11.69 | 21.25 | 10.34 | (6) | 167,219 | |||||||||||||||||||||||

|

Corporate Financial Goals

The corporate financial goals for the 2017 GAIP bonuses were based on the Company’s consolidated net income and were set at $58.0 million of net income at threshold (the level at which the bonus pool began to accumulate), $64.5 million of net income at target and $70.9 million of net income at maximum. The Committee selected these net income levels, which were approved by the Board, because of their correlation to the 2017 budgeted adjusted net income of $64.5 million, the level of improvement over 2016 adjusted net income and the difficulty of achieving these targets in a very challenging business environment.

When the Committee set the 2017 GAIP targets, it also approved certain significant non-budgeted business circumstances for which adjustment could be made by the Committee to the reported net income for purposes of calculating the award. They included site consolidation expenditures for consolidating U.S. operations beyond budgeted amounts; customer bankruptcies or customer plant shutdowns; change in accounting principles; unusual factors driving an increased tax rate; non-recurring adjustments to income such as asset write-downs or write-offs, restructuring and related charges and first-year acquisition costs/losses; adverse legal judgments, settlements, litigation expenses, and legal (including value-added-tax (“VAT”) assessments) and environmental reserves; expenditures for discretionary Board initiated or approved corporate actions, plans or major initiatives, including individual personnel actions; changes in foreign exchange rates; and interest expense from the Company’s share repurchase program. To be “significant” an individual effect must have a pre-tax impact of at least $200,000, or the pre-tax equivalent for tax adjustments. No adjustment to earnings is applied unless the aggregate total of all effects is at least $1 million on a pre-tax basis.

In 2017, reported net income was $20.3 million. Under this net income level, no corporate award would be earned. The Committee considered nine non-budgeted items in determining the actual payout percentage. These nine non-budgeted items mainly reflect non-GAAP items outlined in our reported financial results for fiscal 2017, plus an additional adjustment relative to an accounting standard update. The Committee used its discretion to adjust the net income amount downward to exclude the equity income from a captive insurance company, to exclude the proceeds of an insolvency recovery related to a former insurance carrier, and to exclude an adjustment related to a tax benefit in connection with an accounting standard update. The Committee also adjusted the net income upward to adjust for Houghton combination costs, the effect of the recent U.S. tax reform, a pension-related settlement, a cost streamlining initiative, a loss on the disposal of an available for sale asset, as well as adjusting for the currency conversion impacts of the Venezuelan Bolivar Fuerte. Accordingly, taking into account the adjustments made by the Committee, all participants earned an award equal to 55% of the maximum potential for the corporate component of the overall GAIP bonus.

Individual Goals

When setting the individual goals under the GAIP, the Committee receives specific input from the CEO and reviews the approved operating plan for the upcoming fiscal year. The CEO also recommends the goals for the other Named Executive Officers and works withother members of the Committeeexecutive leadership team, we adjusted the upper end of the Individual Performance Modifier to determine his own individual goals. The Committee works closely withaddress any person whose target total direct compensation is below the CEO25th or 50th percentiles in order to reviewensure the respective executive is closer to their target total direct compensation.

| Performance Rating | Individual Performance Modifier (ability to pay up to 200%) | ||||

| Outstanding | 150 - 200% | ||||

| Very Successful | 125 - 140% | ||||

| Successful | 100 - 110% | ||||

| Needs Improvement | 50 - 80% | ||||

| Unsatisfactory | 0% | ||||

2024 Proxy Statement | 43 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

| Region | Percentage of AIP Target | |||||

| 130% | |||||

| Americas | ||||||

| EMEA | 116% | |||||

| APAC | 127% | |||||

probabilities and risks of achieving these metrics. Ultimately, the Committee approves the individual goals for the CEO and the other Named Executive Officers. For 2017, the Committee determined that these goals were difficult for theThe Named Executive Officers to achieve but achievable with substantial effort by eachearned an award between 130% and 163% of them.

In 2017, Mr. Barry’s individual goals included, among other things, achieving the 2017 financial plan (with focus areas including sales and EBITDA (which we defined as net income before interest, taxes, depreciation and amortization) growth per the approved budget); executing the Company’s strategic plan for each business segment (with focus areas including achieving established goals for the key account management program and customer relations management system); strengthening the Company for the future (including beginning worktheir target award opportunity, based on a business transformation project in oneall of the Company’s regions); completing additional North America sites for the Company’s Responsible Care initiative; completing one acquisition in 2017 or early 2018 if appropriate; completing the required integration planning for the Houghton combination; completing major Company programs (including the Company’s safetyAIP results above. The 2023 year-end base salary target and sustainability initiativesmaximum incentive opportunity and the finalization of the Company’s “economic value added” performance analysis for each region);AIP bonuses awarded and providing appropriate governance and risk management for the Company (including having no material weaknesses or restatements to earnings in 2017 and completing and reviewing with the Board the Company’s enterprise risk management program).

Because the Committee determined that Mr. Barry had met 100% of his established individual GAIP goals, he was awarded 100% of his individual objectives portion of the GAIP bonus. The majority of Mr. Barry’s goals were qualitative in nature, however, one of Mr. Barry’s goals did have quantitative components. The 2017 financial plan included the key metrics of sales and EBITDA growth as areas of focus. Despite the challenging global economic environment, sales and adjusted EBITDA results in 2017 were records for the Company with adjusted EBITDA results surpassing the results from both 2015 and 2016. Net sales increased by 10% year over year and adjusted EBITDA was up 8% from 2016, exceeding $100 million for the third consecutive year and for only the third time in Company history. Our average stock price in 2017 was $142.29 per share compared to $94.74 per share in the prior year, a more than $47 increase year over year, which equates to a 50% increase year over year and an all-time record share price.

The individual goals of the other executive officers were a mix of limited quantitative performance objectives (for the regional associates) and managerial goals, such as achieving regional business and operating budgets; achieving capital expenditure targets; achieving certain contribution margin levels; achieving certain net cash flow targets; ensuring that strategic planspaid are properly executed for his or her area of responsibility; continuing to implement Company safety programs to strengthen the safety culture; upgrading the Company’s enterprise risk management processes and programs; developing a global rather than regional insurance program and completing an acquisitionnoted below:

| Name | Target and Maximum Incentive Opportunities | AIP Bonus Awarded | ||||||

| Andrew E. Tometich | 100-200% | 163% | ||||||

| Shane W. Hostetter | 65-200% | 130% | ||||||

| Joseph A. Berquist | 65-200% | 163% | ||||||

| Jeewat Bijlani | 65-200% | 163% | ||||||

| Melissa Leneis | 65-200% | 163% | ||||||

For 2017, the Named Executive Officers (other than Mr. Barry) had the following individual or regional goals:

Ms. Hall had two quantitative goals of increasing the Company’s overall contribution margin (defined as the overall selling prices of Company products minus all variable costs) and meeting or exceeding the budgeted

|

|

Although our shareholders approved the 2016 Long-Term Performance Incentive Plan (“2016 LTIP”) at our 2016 annual meeting of shareholders, the long-term incentive awards discussed in the Compensation Discussion and Analysis section of this proxy statement were awarded under the 2011 Long-Term Performance Incentive Plan (“LTIP”) before the 2016 LTIP was approved, unless otherwise stated. No additional grants or awards2023 were made under thein cash.

Under the LTIP, stock options, restricted stock, long-term cash payments and other types of awards can be made to participants. This plan is intended to assist us in attracting, retaining and motivating employees, non-employee directors and consultants through the use of compensation that rewards long-term performance. The use of stock-based compensation in our long-term incentive plan balances the cash-based annual incentive bonus and cash portion of our long-term performance plan.bonus. The Committee believes that stock ownership by management and equity-based performance compensation arrangements are useful tools to align the interests of management with those of Quaker’s shareholders. Underour shareholders and long-term performance of the LTIP, a three-year performance period is used.Company. Generally, employees selected as award recipients hold key positions impacting the long-term success of Quakerthe Company and its subsidiaries. These awards are based on overlapping three-year performance periods, so a new program starts each yearperiods.

Underare as follows:

The Committee reviewed current trends in ROIC is calculated as the net operating profit after tax, divided by the sum of (a) short-term debt, plus (b) long-term compensation practices with Towers Watson. The most recent review confirmed that Quaker’s practices were generally consistent with those of other public companies and are as follows:

44 | 2024 Proxy Statement | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

| Award Type | Allocation Percentage | Period | ||||||

| Performance Stock Units (PSU) | 60% | 3-year performance period | ||||||

| Time-based Restricted Stock Awards (RSA) | 40% | 3-year ratable vesting | ||||||

| Total | 100% | |||||||

| PSU Award Measure | Weighting | Award Parameters as a % of Goal | Summary | ||||||||||||||

| Metric | By Metric | Minimum Threshold Performance and Payout | Target Performance and Payout | Maximum Performance and Payout | Notes/Comments | ||||||||||||

Relative TSR(1) | 50% | 25th Percentile | 50th Percentile | 75th Percentile | •Performance period from January 1, 2023 through December 31, 2025 •PSUs capped at 200% of grant | ||||||||||||

| Payout: 50% | Payout: 100% | Payout: 200% | |||||||||||||||

Adjusted ROIC(2) 3-year average | 50% | XX%(3) | XX%(3) | XX%(3) | •Performance period from January 1, 2023 through December 31, 2025 •ROIC metric introduces capital returns to long term compensation •PSUs capped at 200% of grant | ||||||||||||

| Payout: 50% | Payout: 100% | Payout: 200% | |||||||||||||||

| Total | 100% | ||||||||||||||||

The relative value of each(a) one-month average stock price at the beginning of the three categories of awards is roughly equal at the time of grant assuming target performance for the cash portion. The starting point for determining the Named Executive Officers’ LTIP award is to first determine the percentage of base pay for each position at the 50th percentile of market comparables.

Similar to the other components of total direct compensation, other factors in determining the actual percentage of base salary are taken into consideration such as experience, breadth of responsibilities, tenure in the position, whether the position held is for succession planning purposes, overall individual performance and internal equity. Based on recommendations from the Committee’s outside compensation consultants as to typical plan design, the Committee decided to divide the total LTIP award into three components, allocated equally (based on fair value) to stock options, restricted stock and a target cash award.

In the first quarter of 2017, the Committee selected participants for the 2017-2019 performance period, including all of the Named Executive Officers. The specific amount of each award was determined based on market data provided by Towers Watson, as welland plus (b) any dividends paid over that period.

Under the 2016performance period.

2024 Proxy Statement | 45 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

Design from 2022

| 2022 LTIP Design | → | 2023 LTIP Design | ||||||

Vehicle Mix •~33.3% performance-based (PSU) •~33.3% time-based (RS) •~33.3% stock options* | Vehicle Mix •60% performance-based (PSU) •40% time-based (RS) •Eliminated stock options | |||||||

LTIP PSU Metrics •Relative TSR, compared to S&P 400 MidCap Materials Index – 100% | LTIP PSU Metrics •Relative TSR, compared to S&P 400 MidCap Materials Index – 50% •Three-year average adjusted ROIC – 50% | |||||||

Restricted Stock Vesting •Cliff vesting schedule | Restricted Stock Vesting •Ratable vesting schedule | |||||||

| 2023-2025 Performance Period | |||||||||||

| Name | Target PSU Opportunity Grant (units) | Restricted Stock Awarded (shares) | Percentage of Base Salary | ||||||||

| Andrew E. Tometich | 7,264 | 4,843 | 248% | ||||||||

| Shane W. Hostetter | 1,862 | 1,241 | 123% | ||||||||

| Joseph A. Berquist | 2,328 | 1,552 | 130% | ||||||||

| Jeewat Bijlani | 2,162 | 1,441 | 130% | ||||||||

| Melissa Leneis | 2,661 | 1,774 | 165% | ||||||||

46 | 2024 Proxy Statement | |||||

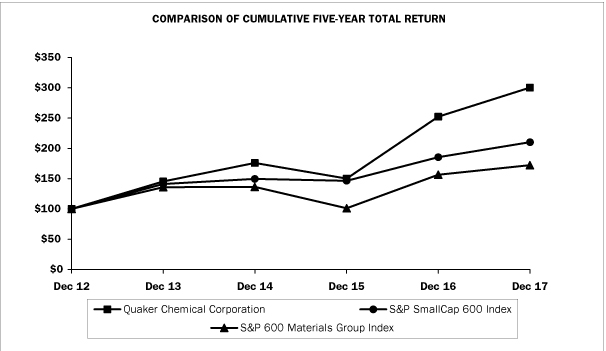

| 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | |||||||||||||||||||

Quaker Chemical Corporation | $ | 100 | $ | 145.30 | $ | 176.12 | $ | 150.05 | $ | 252.15 | $ | 300.12 | ||||||||||||

S&P SmallCap 600 Index | 100 | 141.31 | 149.45 | 146.50 | 185.40 | 209.94 | ||||||||||||||||||

S&P 600 Materials Group Index | 100 | 135.80 | 136.20 | 101.28 | 156.67 | 172.21 | ||||||||||||||||||

Index, respectively.

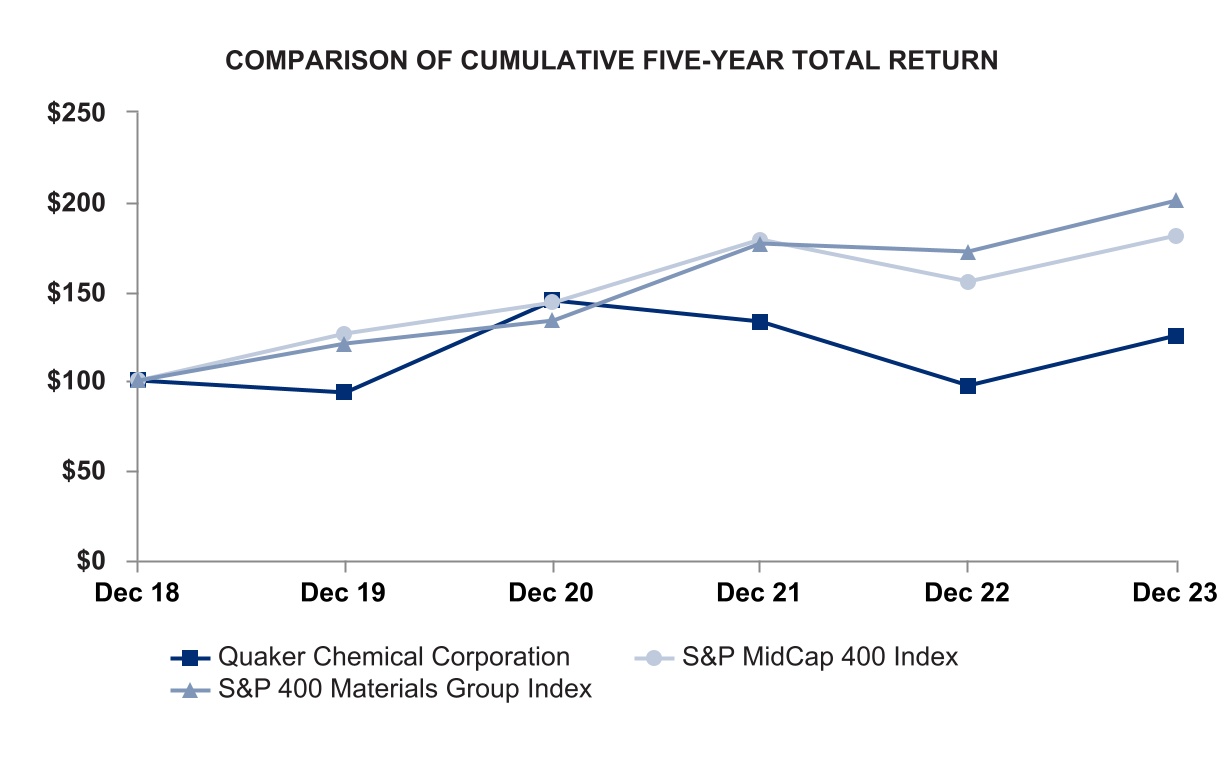

| 12/31/2018 | 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 | 12/31/2023 | |||||||||||||||

| Quaker Chemical Corporation | $100.00 | $93.35 | $145.07 | $133.00 | $97.21 | $125.53 | ||||||||||||||

| S&P MidCap 400 Index | 100.00 | 126.19 | 143.43 | 178.94 | 155.57 | 181.14 | ||||||||||||||

| S&P 400 Materials Group Index | 100.00 | 120.87 | 133.74 | 176.84 | 172.01 | 200.44 | ||||||||||||||

2024 Proxy Statement | 47 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | |||||

| CEO Compensation Summary | |||||

Initial 2023 Base Salary Rate ($)(1) | 800,000 | ||||

New 2023 Base Salary Rate ($)(2) | 880,000 | ||||

| 2023 Year-End Total Base Salary Received ($) | 865,538 | ||||

| Total Bonus Potential | 100% at Target 200% at Maximum | ||||

| Actual AIP Bonus Achieved | 125% of personal target award opportunity 100% of total AIP award opportunity Total AIP bonus award of $1,430,000 | ||||

| 2023-2025 Long Term Incentives | Long-term incentive grant opportunity with a value at target equal to $2,184,000, consisting of a target PSU opportunity of approximately 7,264 units and 4,843 shares of restricted stock | ||||